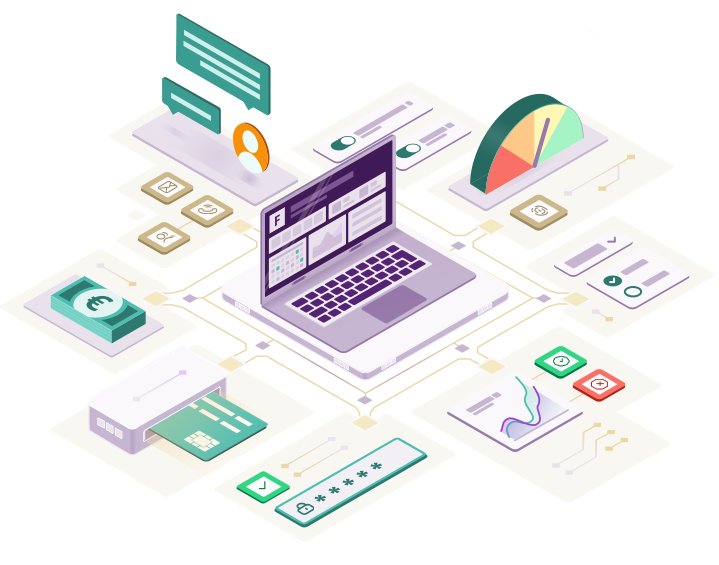

As the backbone of our innovative solutions, the FFT Payment Tech Platform offers a modular platform fabric with frequently-used capabilities, allowing you to drive innovation according to your unique requirements.

You can plug & play any module as per your business need.

Open architectural design with flexibility localize and customize your bespoke solutions.

With our qualified customer-focused and easy-to-use digital payment solution, you ensure a seamless user experience.

FFT Payment Tech brings you proven technology and out-of-the-box capabilities to accelerate the time-to-market for your fintech solutions.

Your cost of ownership is reduced because we also support micro-service architecture and cloud deployment.

You will get a completely secure platform that is PCI SSF standard compliant for users’ data protection and safety.

Platform Core

Give your business a complete turnaround with a solution that comes with a strong base and a mature core.

Microservices

Vertical and Horizontal Scalability

Deployment on-premise/Cloud-agnostic

Integrations and API readiness

Security by Design

Central Administration and Monitoring

PCI-SSF Compliant

Capabilities

A large collection of industrialized and composable capabilities give you the flexibility to rapidly create tailored financial experiences. It’s built as a single platform from the ground up and designed to empower you to innovate on your own terms.

First-class onboarding that drives higher revenue. Give your customers an an intuitive and fast account opening experience.

Ensuring proper KYC management and identity verification for the safety and security of all the users that are onboarded.

Leverage FFT standard regulatory compliance tools – eKYC. Or alternatively, you can replace with your existing or preferred compliance tooling and decisioning.

A wide range of payment options on the platform for all types of transactions ensure you’re supporting customer’s needs

A wide range of options for integrating an elegant, consistent and customer-friendly payment process as part of your checkout process.

Whatever your requirements, FFT meets them: SDKs for mobile apps, hosted payment pages, server-to-server API and Payment.js library with hosted fields.

Ensure full transparent relationship between operator and merchant.

Manage payments from end-to-end, support the lifecycle of a transaction.

FFT Multi-Tier Ledger Management is designed for complex payment flow.

It creates a hierarchical structure of sub-accounts, granting distinct permissions and user access to each level. This unparalleled flexibility caters to the needs of clients, customers, and partners alike.

Customer payment profiles in FFT allow end customers to store their payment methods and use them with all of your sales channels.

The secure payment profiles that can make checkout simple and speedy which create a seamless user-friendly shopping and payment experience.

Automates all your reconciliation and settlement workflows. Optimize the complex process of exchanging and matching up transaction data with third party systems and service providers, consolidating the various disparate formats and displaying them in a centralized and uniform manner.

Multiple types of users align with your business model, with complete transparency and efficiency.

The FFT Risk Management Engine allows you to independently implement your own fraud prevention and risk management strategy. Make it easier to identify and react accordingly to potentially high risk payments.

The associated verification criteria can be configured individually and combined to form risk profiles.

Makes your payment flows fully transparent. Immediate access to all critical KPIs at a glance, and can easily customize your own attractive and insightful dashboard views, define pivot tables directly and export financial reports.

You can automatically transfer data for further analysis to Business Intelligence solutions in your system environment.